I can remember the moment I first incurred debt crystal clearly. It was in the old The Broadway store in Sherman Oaks Fashion Square. It was April. It was 1985. I was 20 years old. It was a pair of sunglasses I didn’t need, but the lenses featured the latest in “blue blocker” technology that was aaaaaaall the rage back in that ancient day. Plus the arms had these flexing springs on them, which was cool. They cost $23.99.

In my bright red vinyl DayRunner organizer were the first two credit cards I’d ever posessed. An American Express card and one from Broadway. How and why I was deemed worthy of them I do not really know. On an earlier lark I filled out an American Express card application. At the time I lived with my mom and my stepfather in their house on Sherman Oaks. I think I made $13,000 in wages that past year. I didn’t even have my own phone. I was working as a courier shuttling visa applications to the various consulates around town for clients. On the Amex app I wrote that my title was Senior Consulate Liaison. I blatantly lied about my salary. I mailed it in. I did the same thing with the department store’s card.

Though I harbored fantasies of my applications somehow being moved down the line unvetted, deep inside I knew better. And when the rejection letter arrived from American Express I was a bit crestfallen, but realistic.

Then, literally the next day, a credit card in my name from The Broadway arrived. It had a $400 limit. I was dumbfounded. And thrilled. I felt as if I’d been given a key to a kingdom I’d never thought’d available to me.

And that’s when the really weird thing happened. About a week later another letter comes from American Express. Inside is their trademark green card with my name on it and a letter telling me something about “after a review of your application we have reversed our decision and now welcome you as an American Express cardmember.”

Doooooood! How? I didn’t care! All I knew was that I had fucking arrived and membership had its privileges! Remember, this wasn’t far beyond the crest of the yuppie craze, which I did my best to emulate — even going so far as to wear suits and ties to classes at LA Valley College. An Amex card was the perfect accessory to that faux lifestyle.

And so there I was a short while later in The Broadway coveting this silly pair of sunglasses and debating whether to just pay cash or put them on one of my various and newly established lines of credit. Of course I did the latter, and when I handed over my Broadway card to the cashier (after ripping open the Velcro closure of my bright red-vinyl DayRunner organizer and pulling the card from its slot, of course) I did so with a little trepidation expected her to slide it and then confiscate it with a “Did you think we would seriously give YOU a card? ”

But instead she just handed me the receipt for my signature and bagged my purchase and that’s the very first moment I went into debt. Oh sure, I may have paid that amount off the moment I got the bill — and I was smart and responsible with my American Express card as well — but then came the other cards. The gas cards and from other stores and Visa and Mastercard and Radio Shack and… well, you know the drill. It may take money to get money, but it doesn’t take much to get credit, and thus it didn’t take long to become burdened by a pretty heavy debt load that I carried around in silent shame like a bad tooth. And it kept getting badder.

Six years ago I owed roughly $17,000 spread out over various Visas and such. At that same time I took the big important step of putting the credit cards away and operated almost exclusively with my debit card. If I didn’t have cash in the bank to pay for something, I didn’t get the something. Amazing how much that helps.

Stopping the credit card usage was a good beginning, but in the two years forward from that, I hadn’t made much of a dent in the overall balance. By 2006 I still owed something like $15,000.

That’s when I got serious and a plan developed and amounts were consolidated and moved via various low-interest balance transfers. But paying that single amount down hit a huge roadblock when I began my 22-month period of unemployment beginning in November 2005 (broken up sporadically with bits of freelancing). A lot of those ridiculouly ineffective minimum payments were made through that stretch, with Susan blessedly coming in to help with several payments during the leanest of those lean times. Then in September of 2007 with the amount down to $13,000 and me starting to work full time, over the past year and a half since I’ve devoted pretty substantial portions of paycheck to paying the pest down.

Better that than my fouled up bottomless pit of a 401K.

Towards the end of 2008 I realized with much astonishment that I could be credit card debt-free by my 45th birthday in May — the first time since that figurative day in April of 1985.

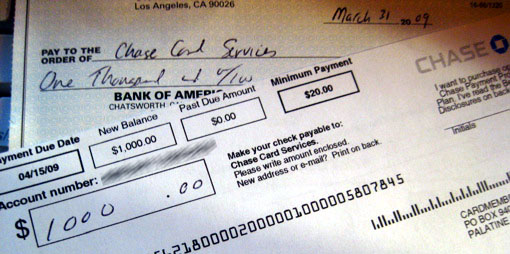

Yesterday the statement from Chase arrived and today I ended things early and ahead of schedule, writing a check that got rid of the last $1,000 of it:

I almost wrote a check for $976.01 so that my final check next month could be the symbolic $23.99 I spent almost 24 years ago. But I said to hell with symbolism. Let’s be rid of this monster once and for all.

Follow

Follow